News

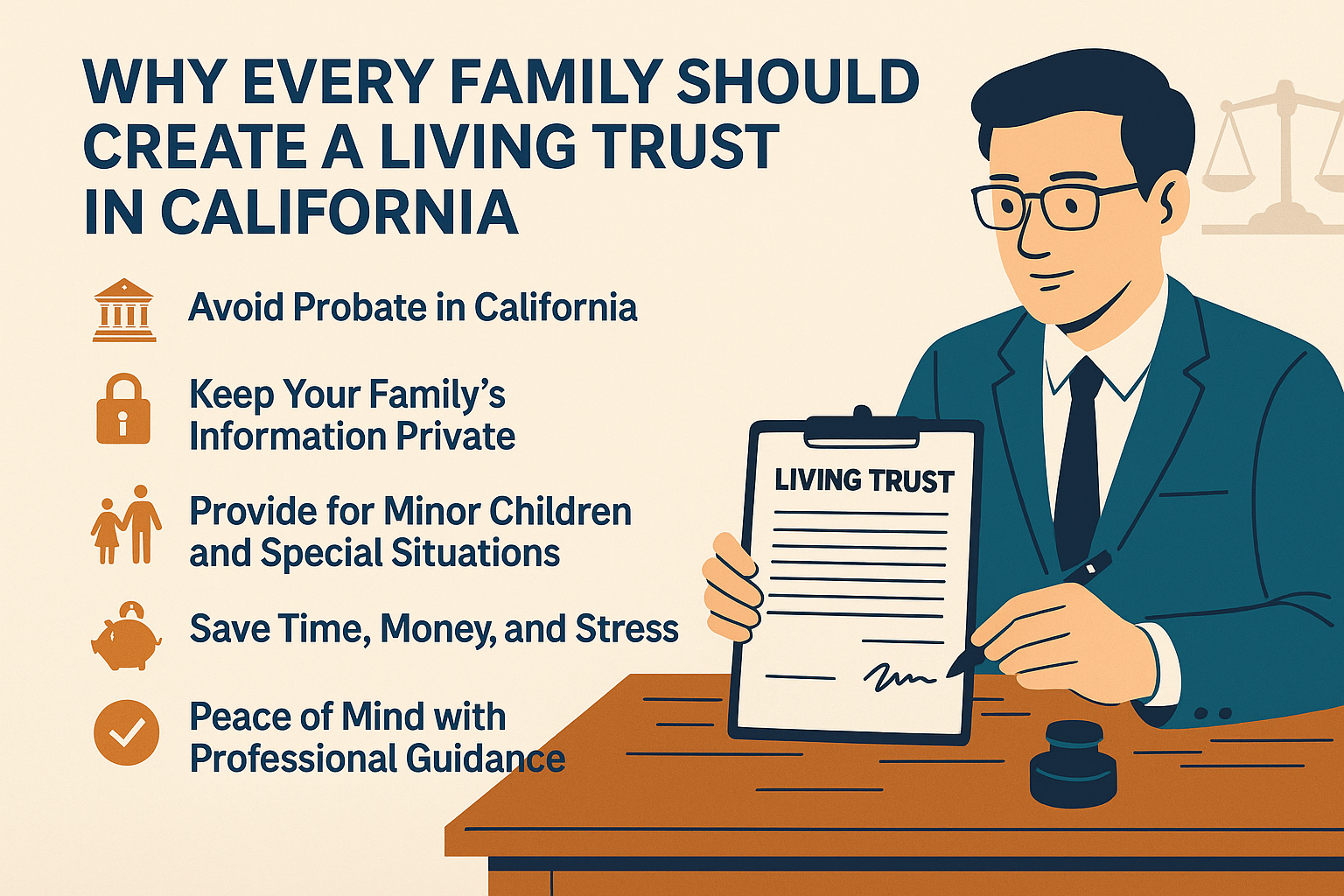

If you own a home, have children, or simply want to avoid legal hassles for your loved ones, creating a living trust in California is one of the smartest steps you can take. A revocable living trust not only helps your estate avoid California probate court, but it also protects your family’s privacy and ensures your assets are managed according to your wishes. 1. Avoid Probate in California Probate in California is often slow, expensive, and public. Even with a will, your estate may have to go through this court process before your heirs can access any of your property. Real-life example: One of our clients in Orange County passed away with only a will. Her family had to wait over a year to settle the estate while continuing to pay mortgage and property taxes. In contrast, another family we helped with a living trust had their assets transferred smoothly within weeks, completely avoiding probate. 2. Keep Your Affairs Private Unlike wills, which become public record in probate court, living trusts remain private. This means your financial matters and your beneficiaries’ identities stay confidential. Real-life example: A couple with multiple properties wanted to ensure that their estate details would not be exposed. A living trust allowed them to pass down their real estate portfolio privately and without court involvement. 3. Protect Your Minor Children A living trust gives you control over how and when your children receive their inheritance. You can appoint a trustee to manage the assets until your children reach a responsible age. Real-life example: A young family tragically passed away in a car accident, leaving behind two small children. Thanks to their living trust, their appointed trustee was able to immediately take over and provide financial support for the children’s care, education, and well-being—without needing court approval.

If we have children under 18, we should appoint a guardian in case we become incapacitated or die. We will avoid the following problems:

If we already have a Living Trust and then refinance the house, the mortgage company will often take the house out of the Living Trust and transfer it back to our personal name. After the refinance is complete, they often forget to transfer the house back to the Living Trust for us. This can cause problems for the heirs later because the house is no longer in the Living Trust and will most likely have to go through the court control (probate).

A Special Needs Trust is a special type of Living Trust that is designed to ensure the care of our loved ones when we die. A Special Needs Trust helps our loved ones live a fuller life while still retaining important benefits. If our children or parents are incapacitated and are receiving government benefits, such as SSI or Medi-Cal, leaving them a direct inheritance may cause them to lose access to these programs. What a Special Needs Trust does:

A Springing Power of Attorney is a type of power of attorney that becomes effective only when a specific event or condition occurs, usually when the attorney becomes incapable of making decisions for himself or herself, such as becoming seriously ill or incapacitated. Until that condition occurs, the attorney retains full authority to make decisions regarding his or her property, health, and legal affairs.

When two people (or more people) co-own a house but cannot agree to divide or sell it, the Court must intervene.

Using a non-attorney to set up a Living Trust can be risky. In short, not using an attorney to set up a Living Trust will save you money. However, the potential risks and complications can far outweigh the initial savings.